A “Now Hiring” sign at a Cookout fast-food restaurant on November 25, 2025 in Durham, North Carolina.

Al Drago | Getty Images

The U.S. labor market likely showed modest improvement in December, providing some encouragement for the year ahead but nothing to get too excited about.

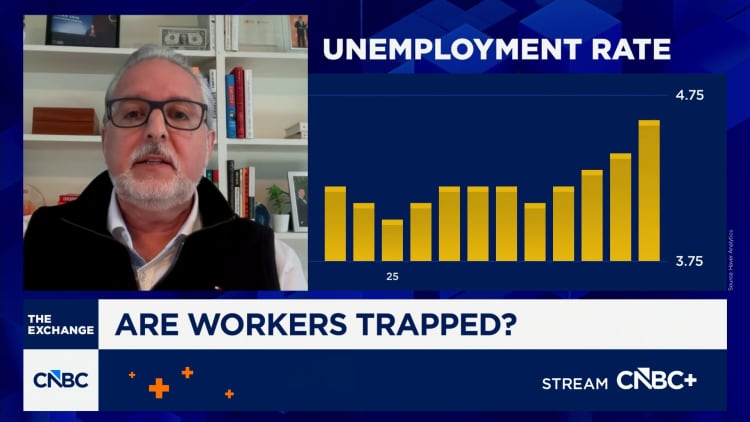

Nonfarm payrolls likely rose by 73,000 last month while the unemployment rate edged lower to 4.5%, according to the Dow Jones consensus. The Bureau of Labor Statistics will release the report Friday at 8:30 a.m. ET.

If those numbers are near accurate, it would represent a slight step up from the 55,000 average monthly gain during the prior 11 months of 2025 and would be a bit better than the initially reported 64,000 for November. The jobless rate is half a percentage point above where it was at the start of last year.

Heading into 2026, most economists see a labor market far from stellar, but at least stable.

“The year is ending stronger than it started,” said Amy Glaser, senior vice president of business operations at Adecco Staffing. “We’ve seen some positivity, both in terms of hiring as well as [a] slow down of layoffs. So [the market is] looking pretty positive going into 2026. I think it’ll be the year of stability.”

The labor market moved in a tight range through most of 2025, from a peak gain of 158,000 in April to a loss of 105,000 in October. Three of the last six months saw net losses.

“We’re just seeing that it’s not too cold, not too hot, it’s kind of right in the middle,” Glaser said. “I think that’s where we’ll continue to see 2026 as folks are cautiously optimistic. We’ll probably see some ups and downs and add a little bit of bumpiness along the way. It may not be linear, but at the end of the day I think the market has proved resilient.”

Though the outward signs of the labor market show unemployment at a very low rate historically speaking, some Federal Reserve policymakers worry that cracks are showing that could grow more pronounced this year.

Policymakers who backed the recent run of three straight interest rate cuts have cited a need to strengthen the jobs outlook as outweighing concerns over inflation reigniting. Fed officials also have cited a “systematic overcount” of payroll growth as a reason for their caution.

Markets have been pinning their hopes that the Fed will intervene again if needed, said Jose Torres, senior economist at Interactive Brokers.

“Confidence has been stronger this year on the expectation that the Fed’s going to ease further,” he said. “That’s really going to bolster the hiring in more cyclically oriented areas.”

Job growth has so far largely been concentrated in areas that benefit from expansionary fiscal policy, particularly health care and government. Glaser expects that trend to continue.

Outside of that pattern, Glaser said the other trend to continue watching in 2026 is retention, or the efforts of companies to keep the staff they have, rather than lay off or aggressively hire.

“Employers are really valuing those that have stayed with them and offering increases in salaries, additional bonuses and perks,” she said. “The one thing that employers that are getting it right are doing … is just this investment in upskilling and reskilling.”

Friday’s release will be the first on-time report since the end of the government shutdown in mid-November. Questions have arisen over the data gaps from the shutdown, with some economists expecting the first “clean” report to come in February.