The Higgs government is projecting another small budget surplus in the coming year, despite projections of continued economic growth and increases in household incomes.

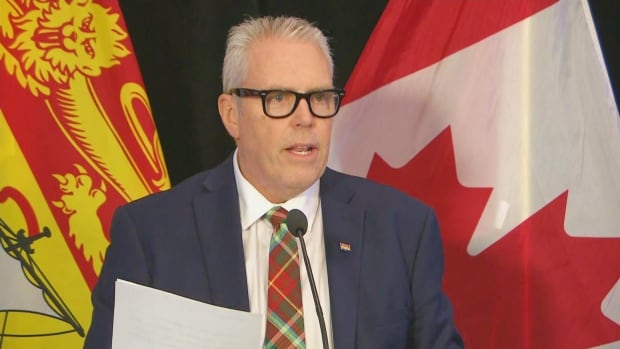

After exploding budget surpluses of $777.3 million last year and $862.2 million, an all-time record, in the current fiscal year, Finance Minister Ernie Steeves says it will drop to just $40.3 million in 2023-24.

Steeves told reporters that’s because a lot of the revenue driving up the current surplus was due to one-time anomalies not guaranteed to repeat themselves in the coming year.

“We ran into some oddities last year,” he said, referring to adjustments to federal calculations that added $433 million in unexpected income tax revenue and transfers due from previous years.

“You just can’t count on things. These are happening at a different pace in New Brunswick now,” he said.

“You can’t count on things staying status quo. It’s a different time. Predicting is very hard.”

The Progressive Conservatives have faced growing pressure to spend more as a result of the two consecutive large surpluses.

‘Groundhog Day’

They’ve also been accused of lowballing their initial budget estimates so they can resist some of that pressure — which economist Richard Saillant says they appear to be doing again this year.

“I think we’re living in the movie Groundhog Day. I don’t see anything different from the last two years,” he said.

“All of the conditions are set for repeating this scenario this year.”

Saillant said even with one-time adjustments to tax calculations boosting revenue in 2022-23, the projections of what he calls a revenue “collapse” in the coming year is unrealistic.

“I suspect this is once again being overly pessimistic with regards to revenue growth,” he said.

The government attributes the projected drop in revenue to several factors, including an income tax cut announced last year worth $70 million, and the loss of $166 million in carbon taxes due to New Brunswick’s coming shift to the federal pricing system.

The one-time adjustment to current-year revenue included $200 million more in personal income tax than expected.

The budget says personal income tax revenue will drop by $116 million, and sales tax revenue will go down by $3.3 million in 2023-24.

That’s despite estimates of household incomes increasing by 3.8 per cent and prices rising by 3.7 per cent — two factors that Saillant says should drive income and sales tax revenue up, not down.

The budget also projects corporate income tax revenue to drop by $318 million.

Too cautious?

Steeves rejected suggestions the Progressive Conservatives have been overly cautious in order to avoid demands to spend more.

“I think we’ve spent a lot since I took this job five budgets ago — spending’s up 24 per cent, we’ve cut taxes but spending’s up 24 per cent. We’ve lowered deficits but we’ve gained population,” he said.

“It’s all good news. For people to say we’re not spending, yes, we absolutely are and we’ve go the numbers to prove it.”

The budget for health care is increasing by $262 million. That figure includes $72 million for the budgets of the two provincial health authorities, $39.2 million to help improve access to primary care and $29.7 million for recruitment and retention.

Of that boost to primary care funding, $10.4 million is to increase the number of doctors working in teams and $8.5 million is to cover the higher volume of services by doctors who bill Medicare.

More for education, social assistance

In education, the government is adding $33.3 million to pay for more teachers and classroom materials for the surge in the number of students going to school. Steeves says enrolment is up by 4,200 students this school year and is expected to jump by another 2,200 next year.

There’s also $30.8 million “to improve our strong inclusive education system.”

The government was criticized earlier this year for not providing enough support for students with learning challenges.

The budget unveils tens of millions of dollars in spending in other areas, including:

-

$4.9 million in new money to repair existing social housing and provide more rent assistance to low-income households.

-

5.9 million more in social assistance payments.

-

$44.9 million to increase wage increases for personal support workers in nursing homes, and $9.7 million for wage hikes for employees working in group homes, community residences, family support and attendant care.

-

$13.7 million so that approved caregivers can claim the same kilometre allowance paid to provincial government employees, and $8.8 million to cover increased operating costs for home support agencies.

-

$32.6 million to fund more police time, including a 15 per cent increase in the number of RCMP officers under the province’s policing contract with the federal force.

-

$3.7 million to train provincial jail staff and case managers to help inmates avoid committing new crimes.

-

$10 million for energy efficiency and conservation programs.

The personal income tax cuts announced in November reduced rates in all income brackets, with the biggest reduction for people earning $142,534 and $162,383 per year.