The Alberta government is set to release an independent report on a potential Alberta pension plan today.

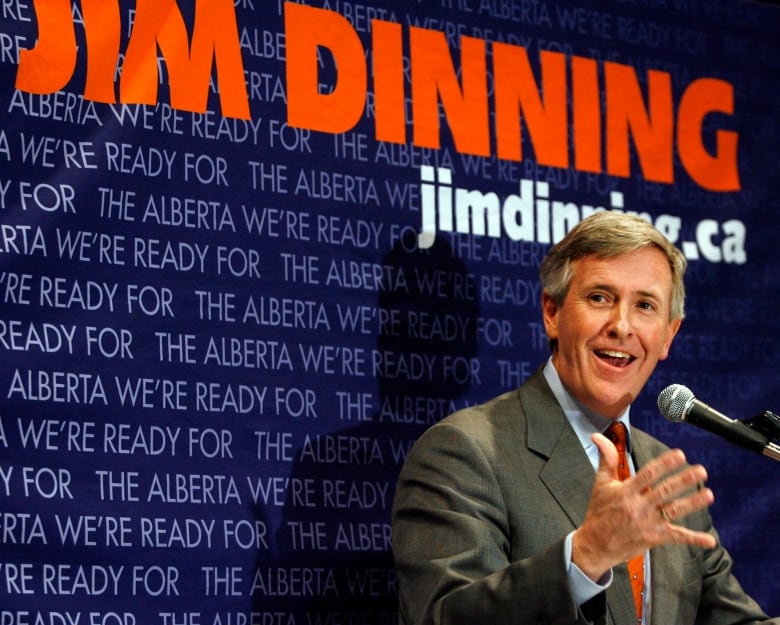

Premier Danielle Smith and President of Treasury Board and Minister of Finance Nate Horner will be present at the press conference, as will former Progressive Conservative finance minister Jim Dinning.

You can watch it live here at 11 a.m. MT.

PREVIOUS STORY FOLLOWS:

The release of the report has been long-anticipated. Smith tasked Horner with releasing it as a part of his mandate letter in July, and to consult with Albertans about whether a referendum should be held on the possibility of establishing an Alberta-only pension plan.

The Globe and Mail reported late Wednesday that, according to multiple unnamed sources, the report concludes Alberta would be entitled to withdraw $334-billion from the Canada Pension Plan, amounting to more than half of the plan’s projected total worth as of 2027.

Alberta economist Jack Mintz, writing in the National Post, cited the same figure.

During her leadership campaign for the United Conservative Party, Smith campaigned on getting Alberta out of the Canada Pension Plan, but withheld such ideas during her provincial election campaign.

Polling conducted for CBC News prior to the kickoff of the election suggested that 60 per cent of Albertans opposed the idea while 31 per cent agreed with it.

Smith discussed the report during her phone-in radio show Your Province Your Premier on Saturday.

“We’ve over-contributed massively. If we had control of our own plan, and we decided to put all of the savings into reducing premiums, it would be substantial,” Smith said. “If we decided to keep the premiums the same and just increase the amount we gave to seniors, it would be substantial.”

On Tuesday, Opposition NDP finance critic Shannon Phillips held a press conference, stating that the province’s plan to “pull out of the Canada Pension Plan” was “based on a flawed and outdated formula that severely overstates the amount Alberta could withdraw from the plan.”

“I have learned of some of the contents of this report. By the very credible accounts that I have been given, [it is] a torqued, misleading, fantasy case for leaving the [Canada Pension Plan] and gambling on an Alberta pension plan,” Phillips said.

In a release issued Wednesday by the province, former Progressive Conservative finance minister Jim Dinning is listed as chair of a panel tasked with engagement around the report. Smith has promised Albertans would get to choose in a referendum whether or not to start an Alberta-only pension plan. She has also recently suggested holding public consultations once the feasibility report is released. It appears those consultations will be led by Dinning.

Long-floated idea in conservative circles

Smith’s enthusiasm for exploring such a proposal traces back years. But suggestions in Alberta that the province go its own way on pensions long pre-date her. Jason Kenney, her predecessor, flirted with the same ideas as part of the “Fair Deal” panel, a series of proposed measures that Kenney said would help the province carve out a stronger position for itself within Confederation.

As a part of the ‘Fair Deal’ panel announced in November 2019, Alberta Premier Jason Kenney said the repatriation of nearly $40 billion in Canada Pension Plan assets would be explored. (Jason Franson/The Canadian Press)

The Kenney government had proposed moves around pensions prior to the announcement of that panel that provoked concern among the province’s teachers and public employees, whose pensions were expected to be transferred to the government-owned Alberta Investment Management Corporation (AIMCo).

Reacting to that news, Smith appeared on a CBC News panel and mused about it being the first step toward an Alberta pension plan.

“That should be something that should concern Ontario and Quebec in particular, as well as the other parts of the country, because there’s a huge transfer of wealth that comes out of Alberta in aid of supporting a lot of these programs, [the Canadian Pension Plan] being one of the most prominent,” she said.

Quebec has had its own pension plan for decades, the only province to operate outside the CPP, so it would actually be unaffected.

In that 2019 CBC panel, Smith also suggested an Alberta pension plan could have provincially directed investment policies — the sort of political interference with pensions that critics have warned about.

“If CPP starts bailing out of energy resources, we don’t want to be in a position where our money is being used to support solar and wind or other experiments that the CPP — driven politically by a Trudeau government — might want to invest in. So I think this is going to be the bigger conversation over the next year or two.”

Prominent conservative figures in the province have been pitching an Alberta pension plan for years. Such an idea can be traced back to the 2001 “firewall letter,” penned by a number of prominent conservative figures, including Stephen Harper, then with the National Citizens’ Coalition, University of Calgary political scientist Tom Flanagan and former Progressive Conservative cabinet member Ted Morton, among others.

“Create an Alberta Pension Plan offering the same benefits at lower cost while giving Alberta control over the investment fund,” the document pitches. “Legislation setting up the Canada Pension Plan permits a province to run its own plan, as Quebec has done from the beginning. If Quebec can do it, why not Alberta?”

How might it work?

Trevor Tombe, a professor of economics at the University of Calgary and a research fellow at the School of Public Policy, said a number of factors will determine the long-term viability of a separate Alberta pension plan.

Perhaps the most important one, in Tombe’s view, is the amount of assets the Canada Pension Plan provides to a potential Alberta pension plan. The 2020 Fair Deal panel suggested the province’s proportion could range from 10 per cent of its total value to 17.5 per cent, but this would all likely have to be negotiated with Ottawa and the other provinces.

“That factor alone governs how much workers would then need to contribute, and what scope there might be for benefit increases,” Tombe said. “So I’ll be looking first to see what are the projected assets that the government envisions.”

Trevor Tombe, an associate professor of economics at the University of Calgary, says a key factor in determining the long-term viability of an Alberta pension plan will be the amount of assets the Canada Pension Plan provides. (Erin Collins/CBC)

Second, Tombe said he’ll be watching for demographic assumptions, as how many workers there are per retiree is critically important in a country like Canada, where there is a lot of mobility across provinces — a variable Tombe said can create a lot of uncertainty and risk.

In a younger jurisdiction like Alberta with a lower average age, there is potential for a separate pension plan to maintain or slightly increase benefits for retirees while keeping contribution rates lower than the national average, Tombe said. But there are risks at play, too.

“Many of those risks are that future demographics are not as favourable for Alberta. Migration is tightly connected, at least historically, to things like oil prices,” Tombe said. “There’s also investment risks — how are the assets going to be used?

“What are the returns that they will generate? The Canada Pension Plan, because it’s broader and almost entirely national in scope, is much better at diversifying some of those risks.”

Proponents of an Alberta pension plan could view it as a potential tool to “poke Ottawa in the eye” by potentially inducing increases in contribution rates within the CPP elsewhere, Tombe said.

“Now, whether or not an Alberta pension plan separate from the CPP would cause the CPP rate to increase depends. It’s not mechanically guaranteed,” Tombe said.