Microchip maker Nvidia Corp. was poised to join an exclusive list of companies worth more than $1 trillion on Thursday as the company said that feverish demand for AI technology was causing booming demand for its products.

The chip designer’s shares — which have already doubled in value this year — jumped by another 28 per cent on Wall Street in premarket trading on Thursday after the company said it is seeing unprecedented demand in just about every facet of its business.

The company’s shares were worth $305 apiece on Wednesday, enough to value the company at more than $750 million US. At one point on Thursday morning they topped $400, enough to value the company at more than $1 trillion US.

Prior to Thursday, only four American companies were in that exclusive club: Apple, Microsoft, Google parent Alphabet and Amazon. Meta and Tesla had previously achieved the feat, but both companies have fallen off dramatically since last year.

If the company manages to hold on to a market gain of at least $210 million until the end of the day, it would mark the biggest one-day increase in value for a U.S. company ever.

Booming demand

The company projected that its quarterly revenue for the second quarter of this year will come in at more than $11 billion. That’s more than 50 per cent higher than what Wall Street was anticipating.

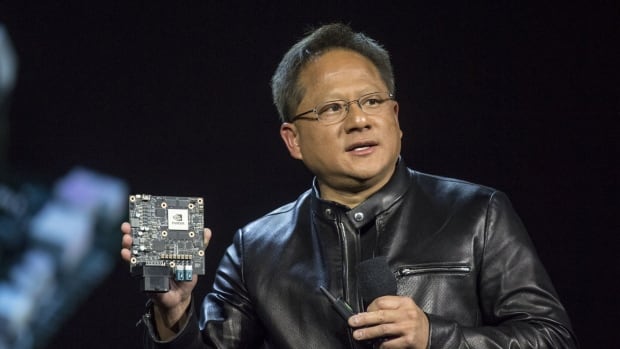

CEO Jensen Huang said demand for chips is strong in its existing businesses, but also emerging in new ones tied to AI.

“A trillion dollars of installed global data centre infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process ” Huang said.

“We are significantly increasing our supply to meet surging demand for them,” he said.

‘A game changer’

Analysts used breathless superlatives to describe the company’s stunning outlook.

“In the 15+ years we have been doing this job, we have never seen a guide like the one Nvidia just put up with the second-quarter outlook that was by all accounts cosmological, and which annihilated expectations,” Stacy Rasgon of Bernstein said.

Dan Ives, a technology analyst with Wedbush, called the company’s forecast a “game changer.”

“Last night Nvidia gave jaw dropping robust guidance that will be heard around the world and shows the historical demand for AI happening now in the enterprise and consumer landscape. For any investor calling this an AI bubble we would point them to this Nvidia quarter and … speaks to the 4th Industrial Revolution now on the doorstep.”