Think back 13 years. A seeming lifetime ago in terms of automotive history. Guys named Mulally and Wagoner were steering Ford and General Motors. Chrysler hadn’t hooked up with Fiat yet, let alone PSA Group.

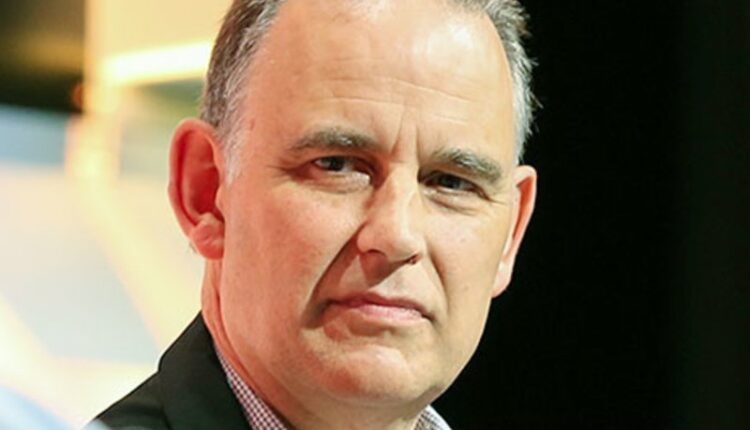

But Bill Kozyra was doing then what he’s doing now: leading TI Fluid Systems, a U.K. company with a big U.S. presence. TI is now a year short of its 100th birthday and stands as one the industry’s top 100 global suppliers. The ranking comes from our annual list, the latest of which comes out with this issue.

Few CEOs can claim that kind of tenure. But it does give Kozyra a unique perch to reflect on the state of the industry, from the eve of the Great Recession to a year after the pandemic hit.

He raised five points when I caught up with him by phone last week. And they point to a bright future, at least from the perspective of a 64-year-old (as of Monday, June 28) Detroit native who got his start in this industry more than four decades ago and is retiring at the end of this year.

1. A healthier industry: The one-two punch of the pandemic and the microchip shortage could have floored a lot more companies. But it didn’t. The Great Recession brought new efficiency and survival lessons that carry on today.

2. Better automaker-supplier relations: Give credit to the car companies for this one, Kozyra says. They were spooked by the recession when they realized that a fragile supply chain threatened their own existence. They now recognize that suppliers are in business to make money, too. There’s more give and take. Negotiations are more intelligent. Purchasing chiefs have come to realize that “you just can’t get blood out of rocks.” What’s more, the Detroit 3 have been challenged by the perennially high scores earned by Honda and Toyota in surveys of supplier attitudes and have worked to improve.

3. Curveballs have become hittable: There’s nothing like surviving two months without revenue to sharpen your swing. But that’s what the supplier world did in spring 2020, when auto factories shut down in response to the coronavirus. Then, within 12 months, another historic, unforeseen crisis: the global microchip shortage. But automakers are finding ways through it. They’re carving out extra capacity from semiconductor companies and discovering how to make vehicles with fewer chips. Through a combination of creativity and flexibility, 2021 is shaping up to be a decent year. “COVID put us in a better position to deal with the chip shortage,” Kozyra says. “It all kind of fit together.”

4. A new way to work: Another surprise benefit from the pandemic: a better way of working. Yes, there will be a transition back to office life — to a degree. But the new norm will mean more work-life balance for employees and lower costs for employers. Certain days might be designated collaboration days, and everyone will head in. “But there will be some fundamental changes,” Kozyra says. “The employee work model will be forever different.”

5. Electrification is changing everything: Kozyra has never seen his world shifting as quickly as it is now. The realities of electrification and autonomy technologies are sweeping over a robust traditional business of making and selling internal-combustion vehicles. There are big EV question marks, particularly around consumer demand and infrastructure. And also some huge operating challenges: “The engineering groups at the OEMs and suppliers are strained to the max.” Some companies won’t survive.

TI, it would appear, doesn’t have to worry about going the way of buggy whip makers.

True, EVs won’t need the fuel lines and fuel tanks that cars have required in the past.

But they have batteries and electronics and charging systems and other hardware that have to be cooled. Those systems, Kozyra says confidently, will require even more fluid-handling parts than typical vehicles do now.